How I Got $450 Off on Credit Card Annual Fees

After reading the pro tips in my "Game of Points: From Noob to Legendary" blog post, many friends have shared that they didn't know you could get fee reductions on your credit card's annual fee.

Today, I want to dive deep into why you should negotiate your annual fee and exactly what to say to see if there are retention offers on your credit cards.

I'll also provide some tips if you can't get a fee reduction and want to cancel your credit card.

Over the last month, I've received $450 in reductions on two of my credit card's annual fees.

- Amex Platinum - This is the third year in a row that I've received a reduction in the annual fee for this card. In the first year they gave me $300 off, last year another $150 off, and this year I was given $300 off after spending $3,000 on the card. These fee reductions greatly tip the scale in favor of benefits over annual costs for this card.

- Southwest Priority Rapid Rewards Card - I got this card a year ago, and my friend Vu let me know that he was able to successfully get a $150 statement credit for the annual fee. Excitedly, I called in and was provided the same $150 statement credit to help offset the annual $149 fee. Oh, and this card has a $75 Southwest Travel credit. We'll end up getting paid this year to keep this credit card.

Okay, so how do you go about getting these sweet retention offers?

- Call the bank that manages your credit card. For Chase credit cards the number is 1-800-432-3117, for Amex it's 1-800-528-4800.

- When the first agent picks up, say "Hi, I'm calling to talk about my ABC Credit Card. Could you transfer me to the customer retention department so that I can learn more about what retention offers you have going on and if I should cancel my card?"

- Depending on the first agent that answers, they may either transfer you directly to their Customer Retention department or in some cases they'll be able to look at retention offers for you.

- Next, they'll probably ask you about what's going on and why you're considering canceling. You can say something along the lines of "I've been a loyal member for X number of years. Although I've really enjoyed having this credit card, I haven't received the value from it that I was hoping for. My annual fee is coming up (or has already been posted) and I'd like to see if there's anything you can do to help reduce the cost for me to keep the card."

- The agent will then take a look to see if there are currently any retention offers. In some cases, there might not be. For example, my Chase Sapphire Preferred card did not have a retention offer available.

- In some scenarios, you may get a really unhelpful agent, and you'll be able to tell based on their vibes. If that's the case, hang up and try again. I had to do this with my Amex card and was successful the 2nd time around.

- If you successfully get a fee reduction, do a little dance because it's a good chunk of change for 5 mins of work :)

What if my credit card isn't worth keeping anymore?

If you find that your credit card isn't worth keeping anymore, there are a couple of things that you can do.

Downgrade - Many credit cards with higher fees can be downgraded to a credit card that has a lower or no annual fee. The pro of downgrading is that you get to keep your credit history. The con is that you likely won't get any bonus points for the card that you're downgrading to, whereas if you were to cancel and apply for the same credit card you would likely be eligible for a new signup bonus.

Cancel - You can always cancel your credit card, but there are short-term implications to consider. You may get dinged on your credit score because you'd be closing down a credit line and potentially decreasing your credit history. However, it does open up the opportunity to reapply for credit cards to earn another round of signup bonuses.

There are a couple of things that you'll want to do before you close out a credit card:

1) Transfer your points to another account. Once you close out a credit card, all the points associated with the card go away too. So be sure to transfer your points to another account or to a travel partner before closing out the card.

2) Ask to Consolidate Your Credit Limit to Another Card. I recently learned that you can consolidate your credit limit from a card that you're closing to another one. If possible, have the agent on the line help you do this, as maintaining your overall credit limit reduces the impact on your credit score.

3) Ask about restrictions on reapplying for the same type of card. Chase has a rule where you can't earn the same signup bonus more than once for a Sapphire Card within 4 years. In addition, you have to wait 30 days or 1 statement period after closing your account before reapplying for the same family of Sapphire cards. So if you plan on credit card churning, be sure to inquire about any limitations and restrictions on future sign-up bonuses.

Mamba Mentality

Something to keep in mind is that banks have every incentive to help you keep your credit cards open. Banks make an unfathomable amount of money on credit cards through annual fees, credit card interest, and interchange fees charged to merchants (that's why some places charge you more to pay with a card).

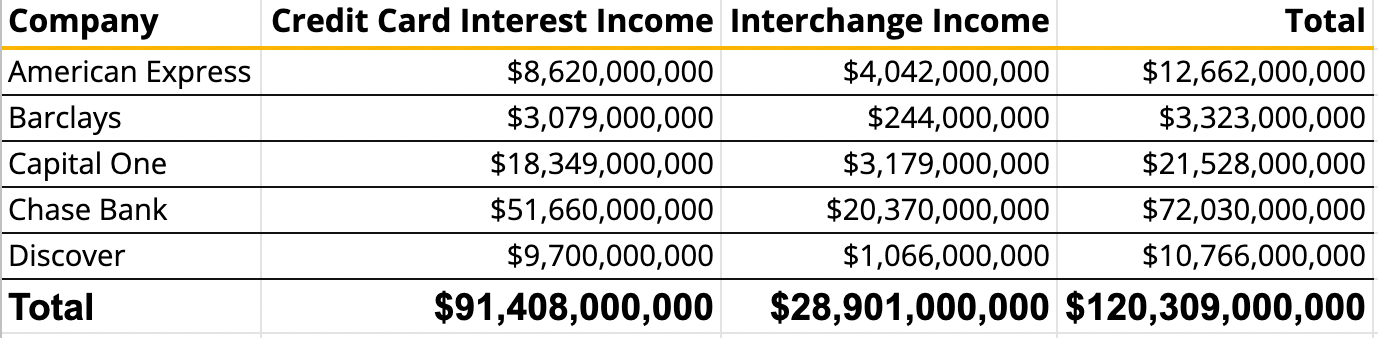

Here's a table that shows the 2019 annual credit card income for five banks from self-reported data.

A couple of takeaways here:

- $91.4 billion of credit card interest is way too high, so if you have credit debt it's time to shut it down. Stop investing in your 401k, no more stocks or crypto, and pay it off as fast as you can. There's no greater investment and return than paying down credit card debt with ~20% interest rates.

- Banks are banking on you spending beyond your means, so they provide these crazy credit card incentives that don't make sense when you first hear about them. But when you see how much they're making off of credit cards, it's clear that more credit card users = more $$$.

- Mamba Mentality. They need you. They want you. A few hundred dollars in annual fee reductions is a literal drop in the bucket. So go forth and fearlessly negotiate fee reductions. :)